Translation and analysis of words by ChatGPT artificial intelligence

On this page you can get a detailed analysis of a word or phrase, produced by the best artificial intelligence technology to date:

- how the word is used

- frequency of use

- it is used more often in oral or written speech

- word translation options

- usage examples (several phrases with translation)

- etymology

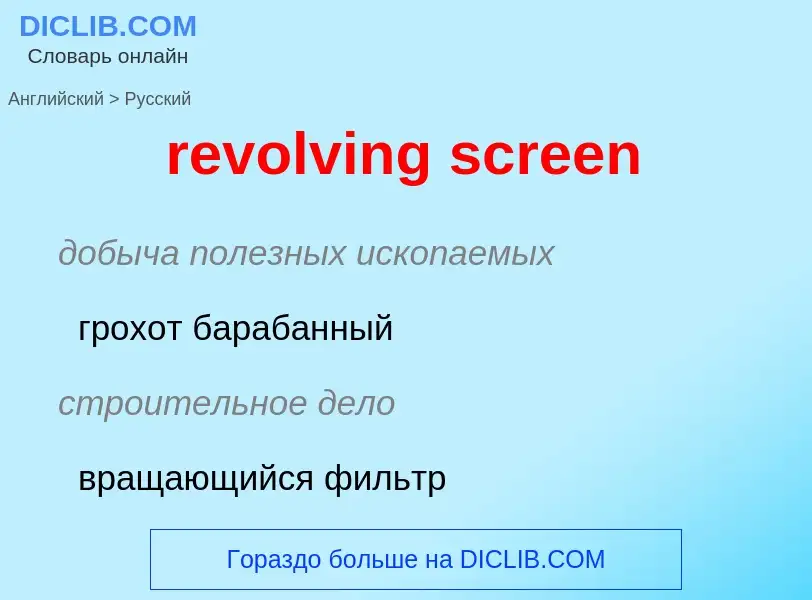

revolving screen - translation to russian

добыча полезных ископаемых

грохот барабанный

строительное дело

вращающийся фильтр

нефтегазовая промышленность

вращающееся сито

Wikipedia

A Revolving Loan Fund (RLF) is a source of money from which loans are made for multiple small business development projects. Revolving loan funds share many characteristics with microcredit, micro-enterprise, and village banking, namely providing loans to persons or groups of people that do not qualify for traditional financial services or are otherwise viewed as being high risk. Borrowers tend to be small producers of goods and services: typically, they are artisans, farmers, and women with no credit history or access to other types of loans from financial institutions. Organizations that offer revolving loan fund lending aim to help new project or business owners become financially independent and eventually to become eligible for loans from commercial banks.

The fund gets its name from the revolving aspect of loan repayment in which the central fund is replenished as individual projects pay back their loans, creating the opportunity to issue other loans to new projects.